Our users

Who needs Flamingo?

Expats &

Digital Nomads

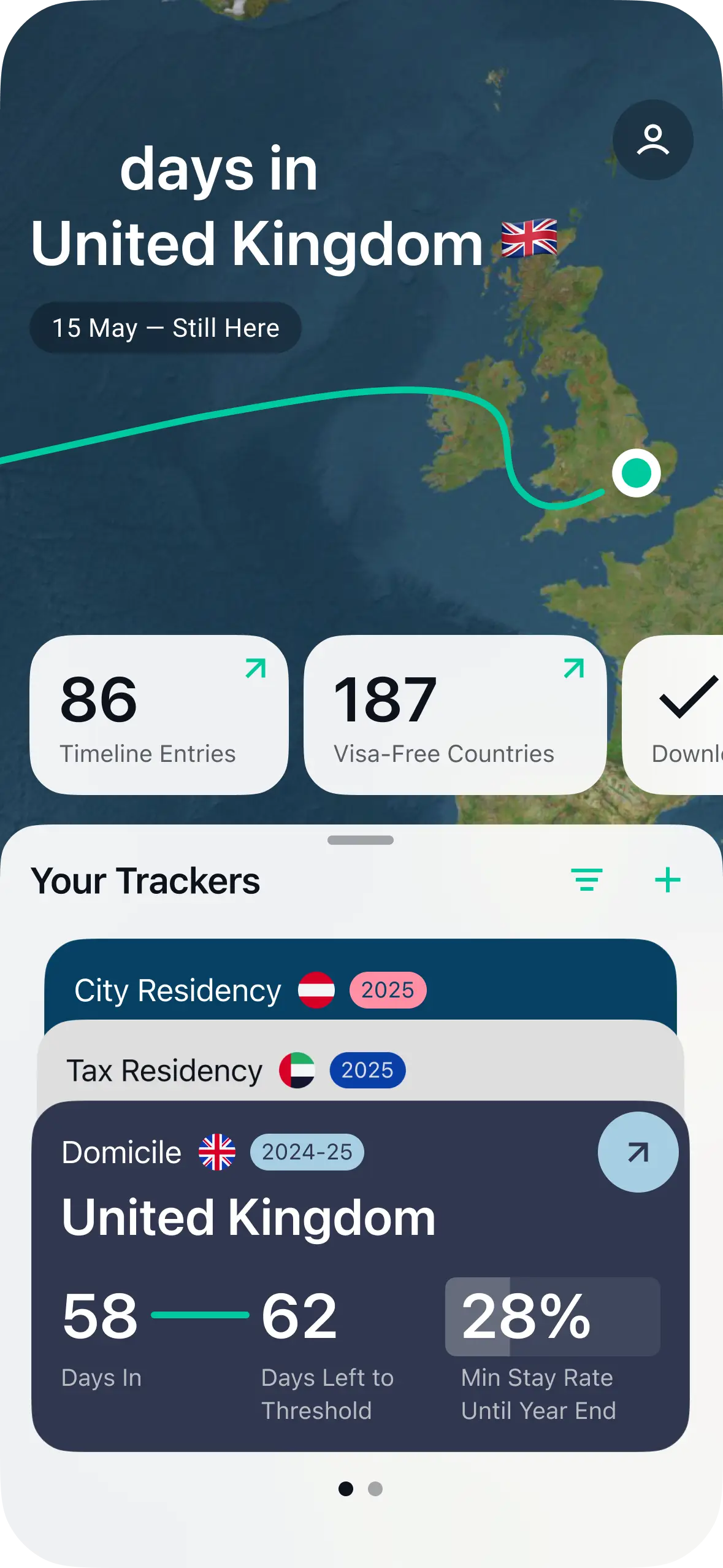

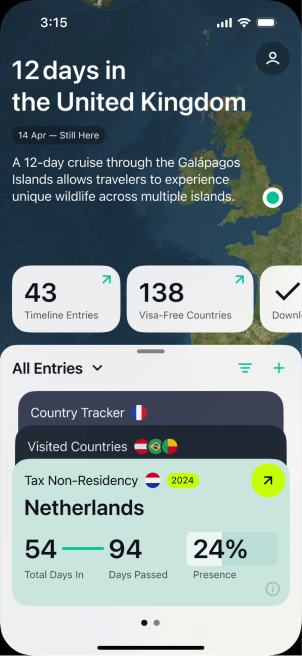

Flamingo Compliance keeps tabs on the number of days and nights spent in your country of residence, proving to be an essential tool for global expats, overseas homeowners, digital nomads, and permanent residents looking for an efficient way to manage their residency obligations.

Tax

Residents

The Flamingo Compliance platform simplifies tax residency management by automatically recording your movements and alerting you when nearing residency thresholds. It also provides detailed, expert-developed reports for easy sharing with authorities, tax consultants and accountants.

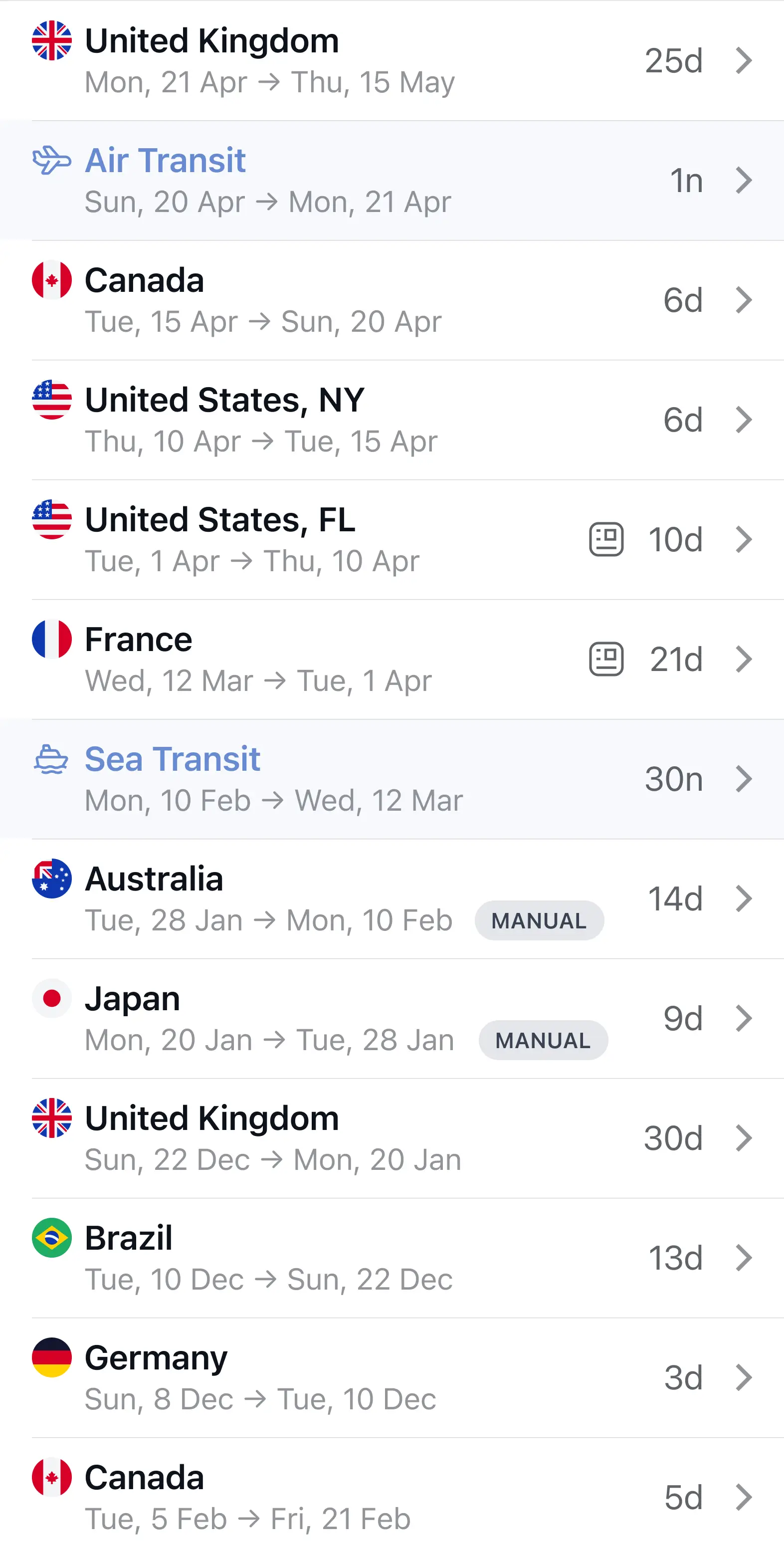

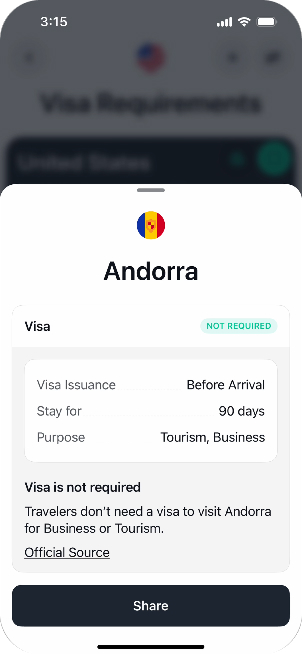

Frequent Travelers

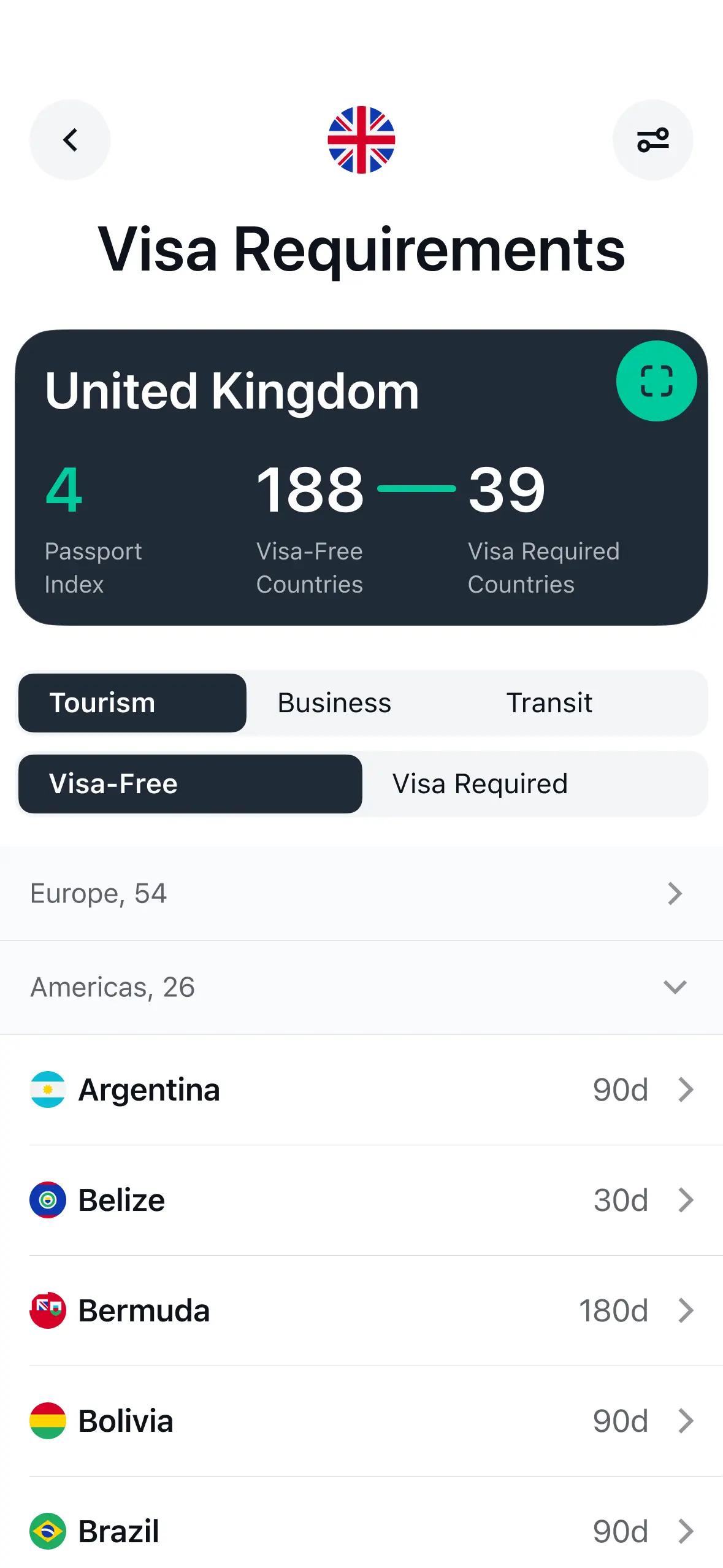

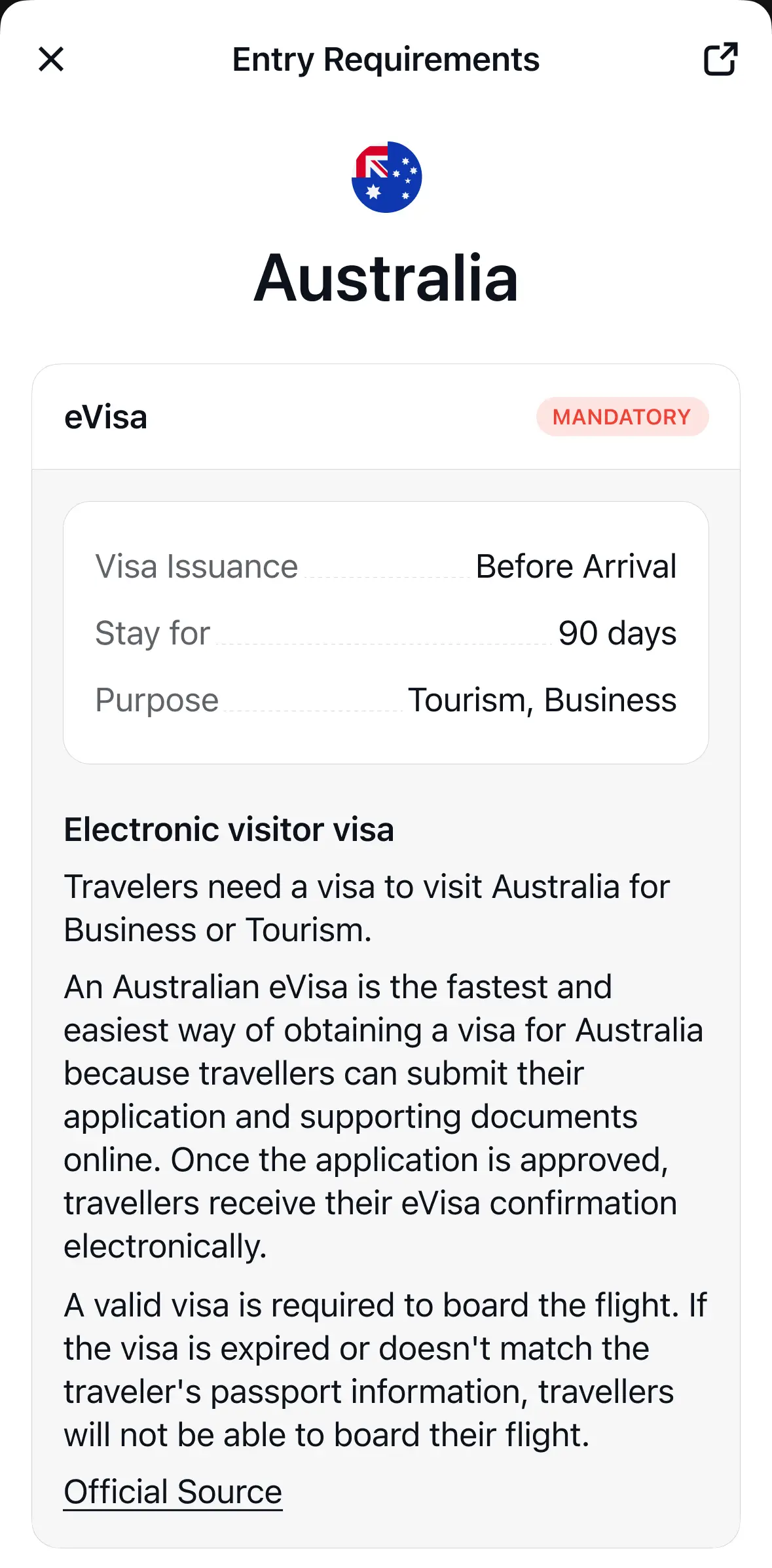

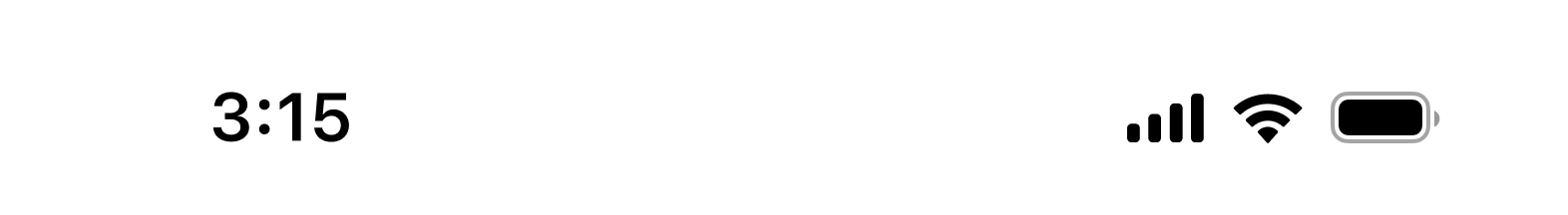

Flamingo Compliance automatically records your border crossings into different countries and US states, while diligently tracking your visas and visa-free stay limits. Whether you travel for business or leisure, the app allows you to view and manage your trip history, add details, and plan upcoming journeys.

Citizens by

Investment (CBI)

Flamingo Compliance is a powerful tool for CBI passport holders managing multiple residencies. Track your presence across countries, avoid accidental tax residency, and stay compliant with visa and permit rules—while keeping your travel history and documents organized and secure.

Features

The Ultimate Compliance Platform

Everything you need to manage tax residency, visas, and physical presence when living and working internationally.

Auto

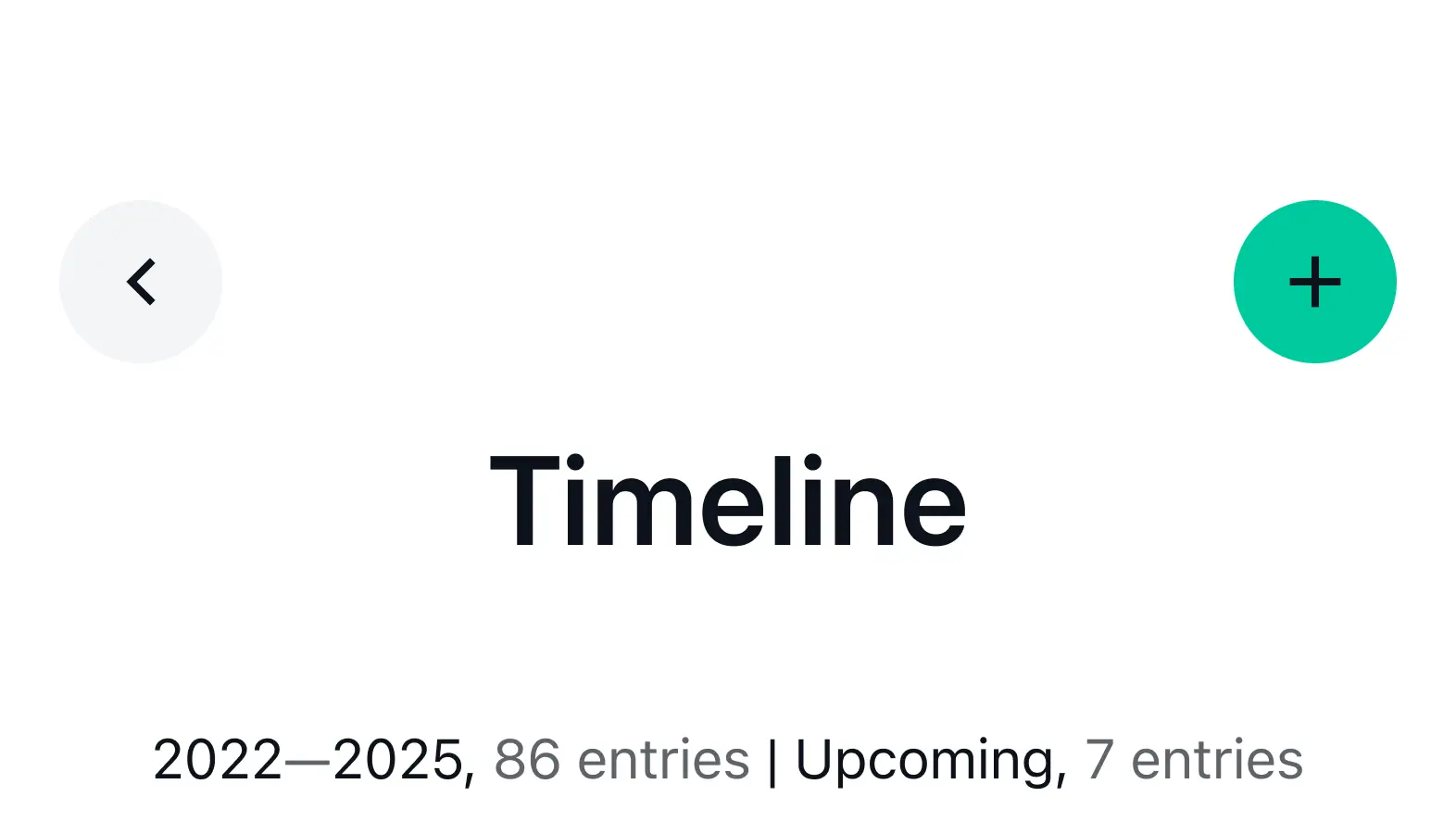

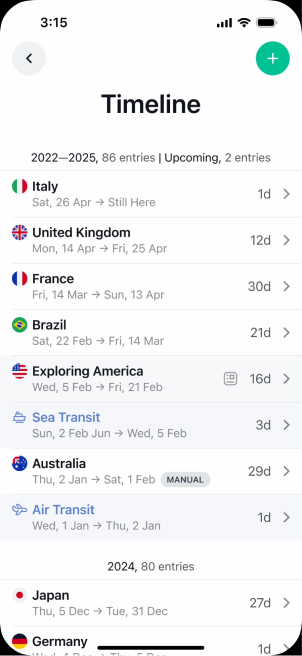

Trip Recording

Flamingo Compliance automatically determines when you cross the border and accurately records your trip details. You can always review your travel timeline in the app and make adjustments for transits as needed.

Plan Future Travel

Store Documents and Trip Details

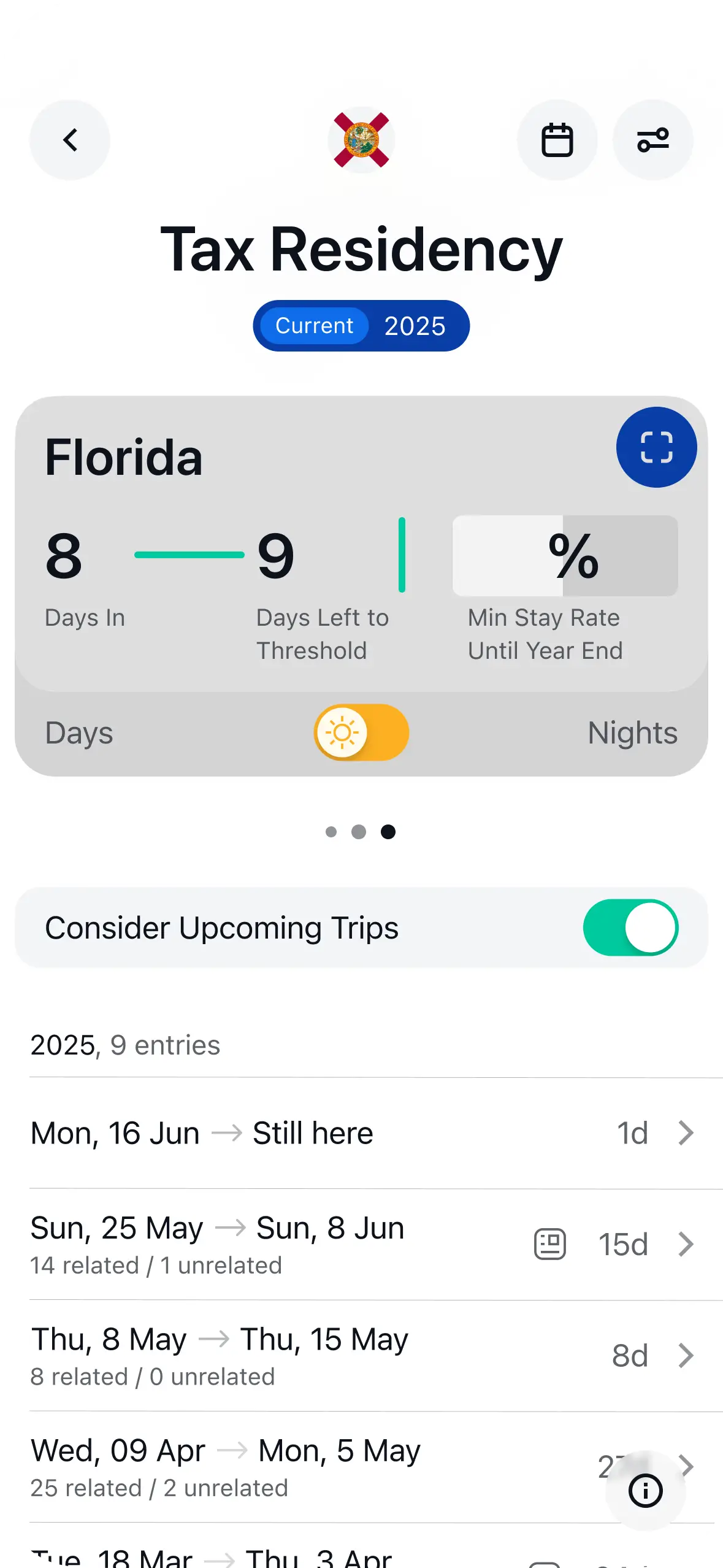

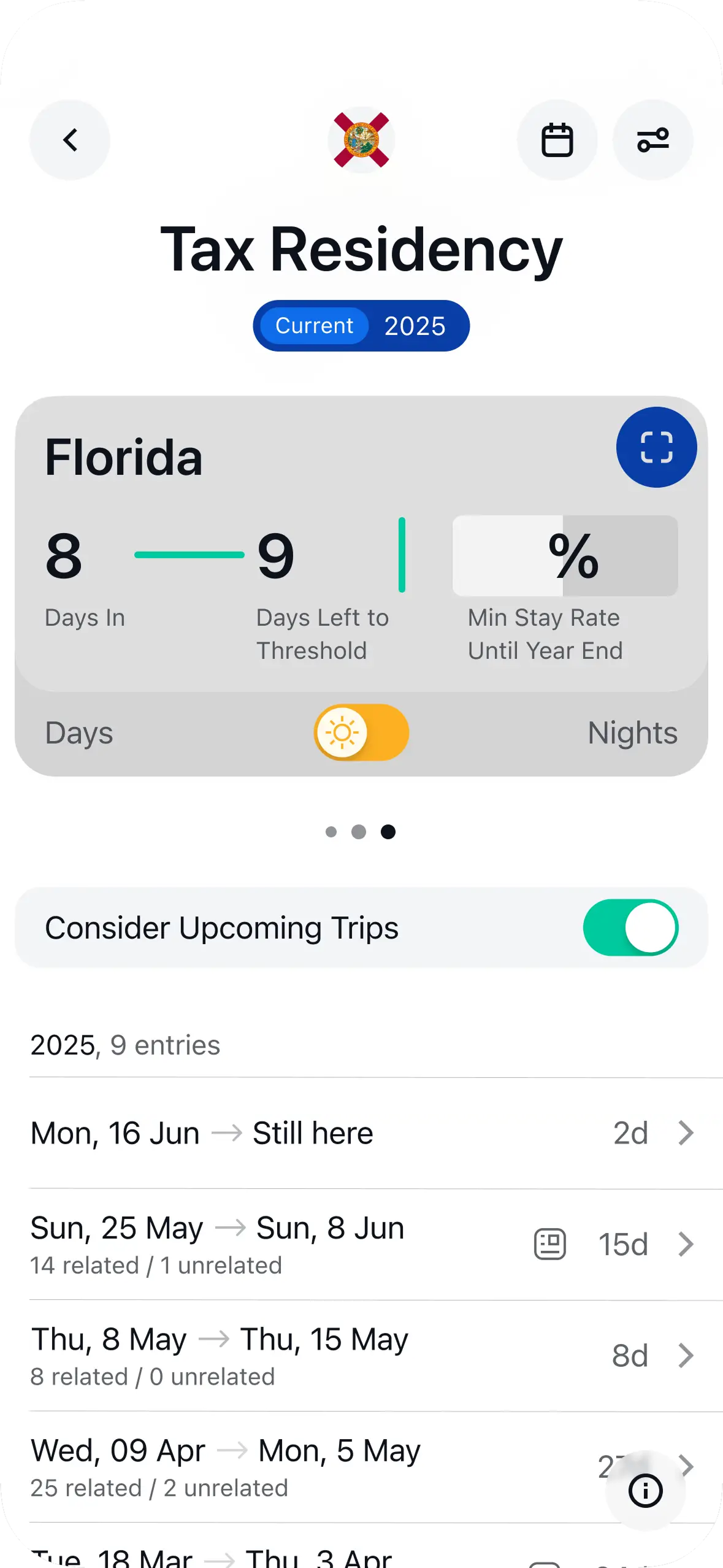

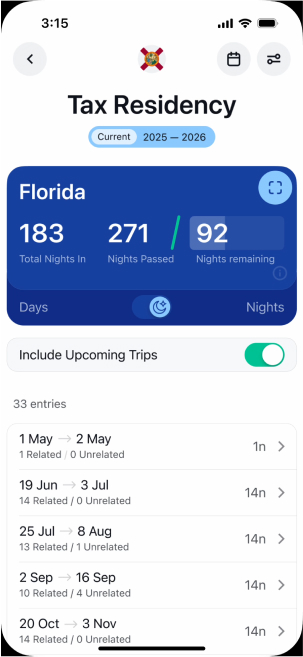

Tax Residency

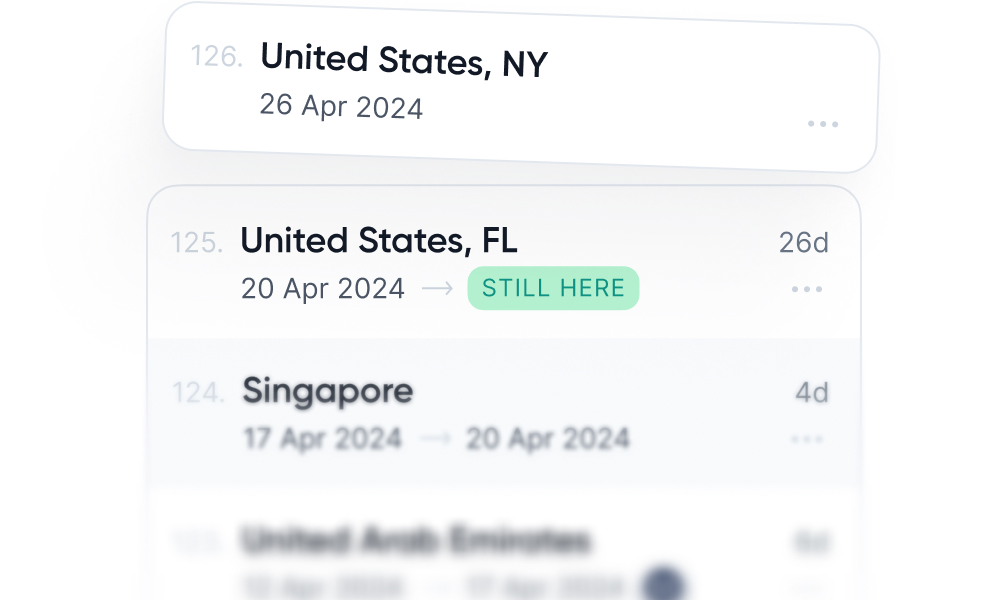

& Domicile Status

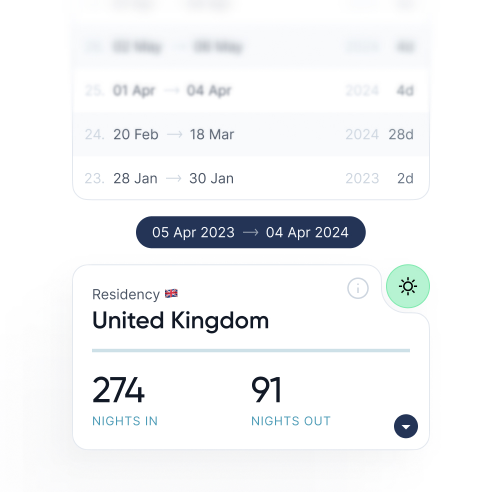

Whether you’re looking to establish, maintain or avoid a domicile or tax residency status, Flamingo Compliance got you covered. Set up a threshold and tracking period and monitor your physical presence in the country or US state. Receive timely alerts about your status to always stay on top of your tax obligations.

Tax

Residency

Assessment

Coming soon

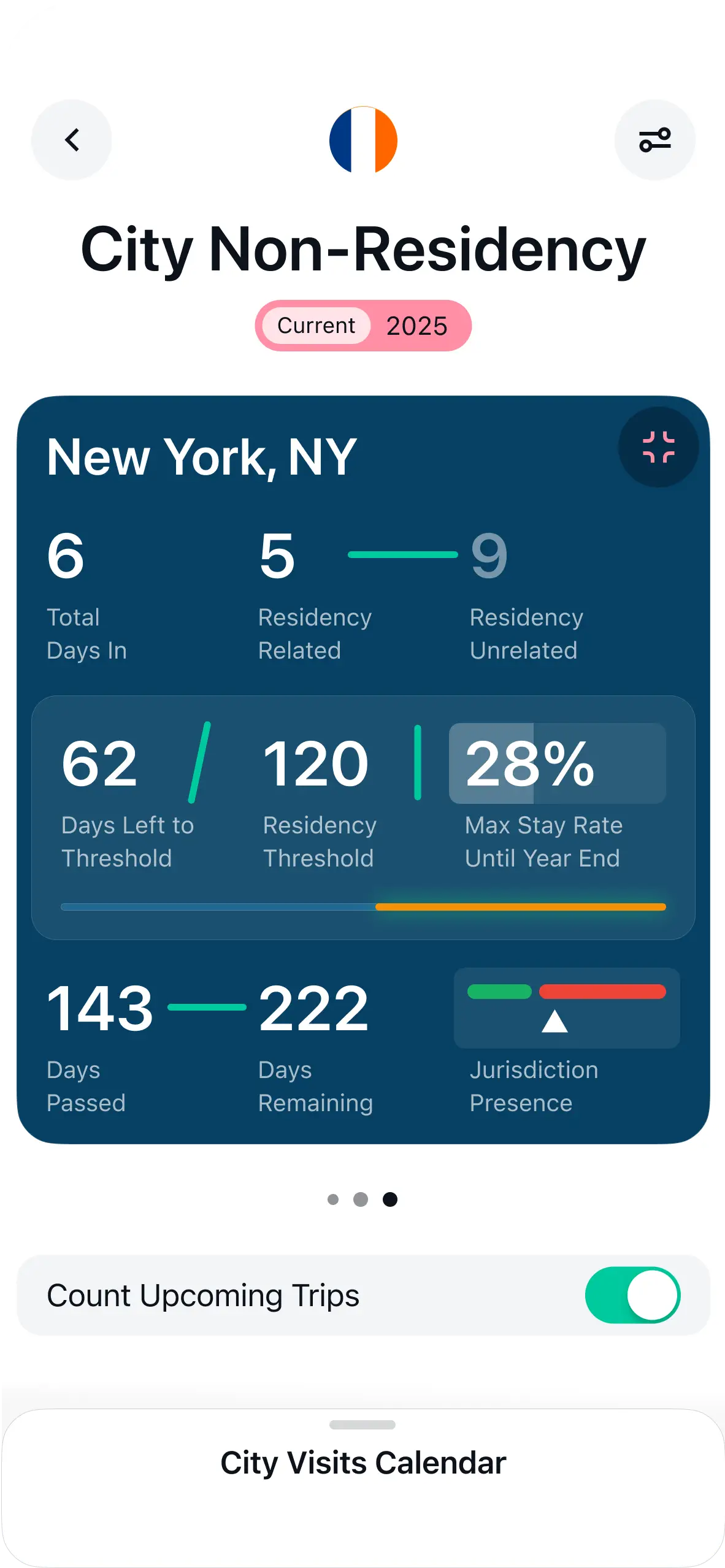

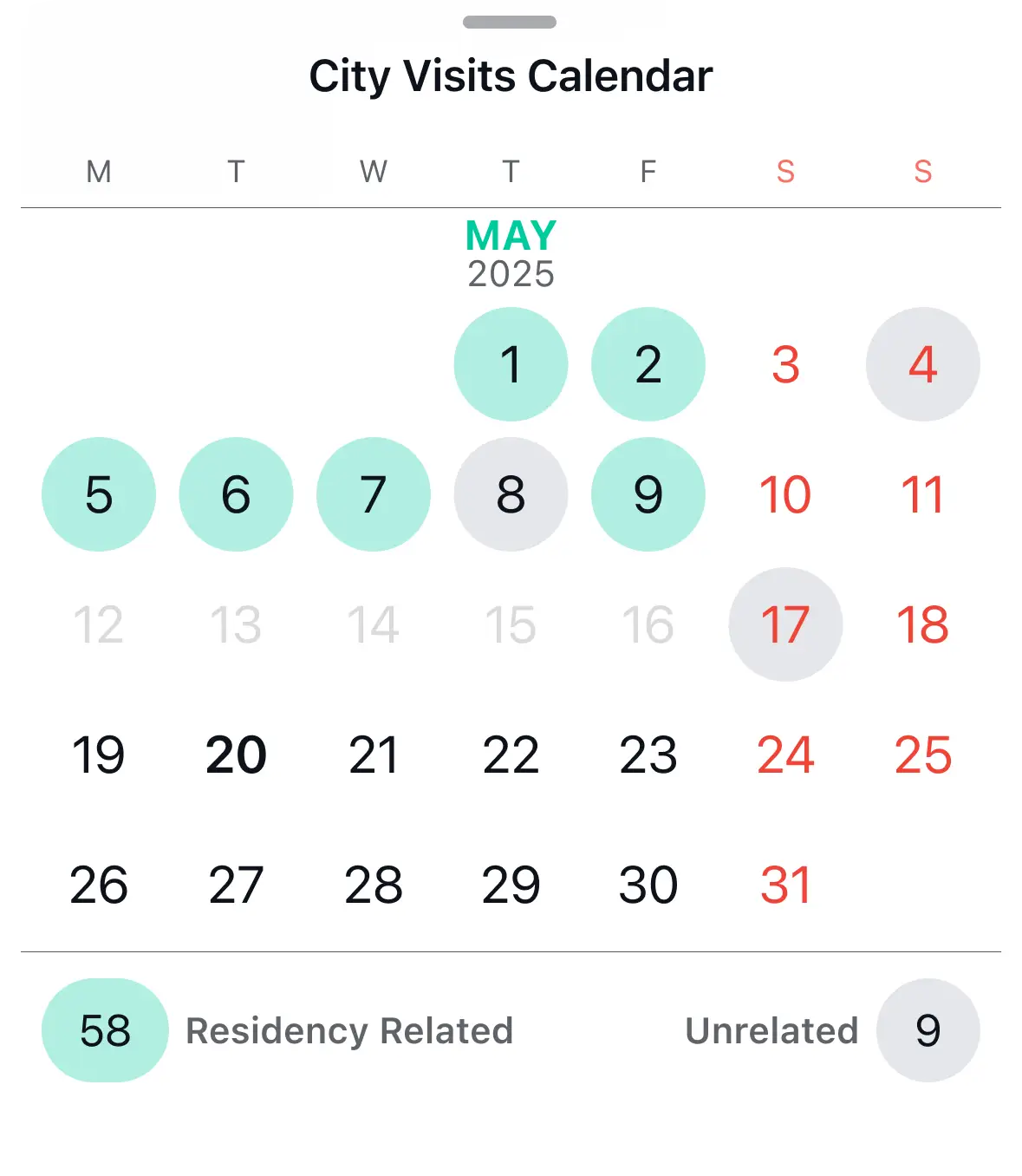

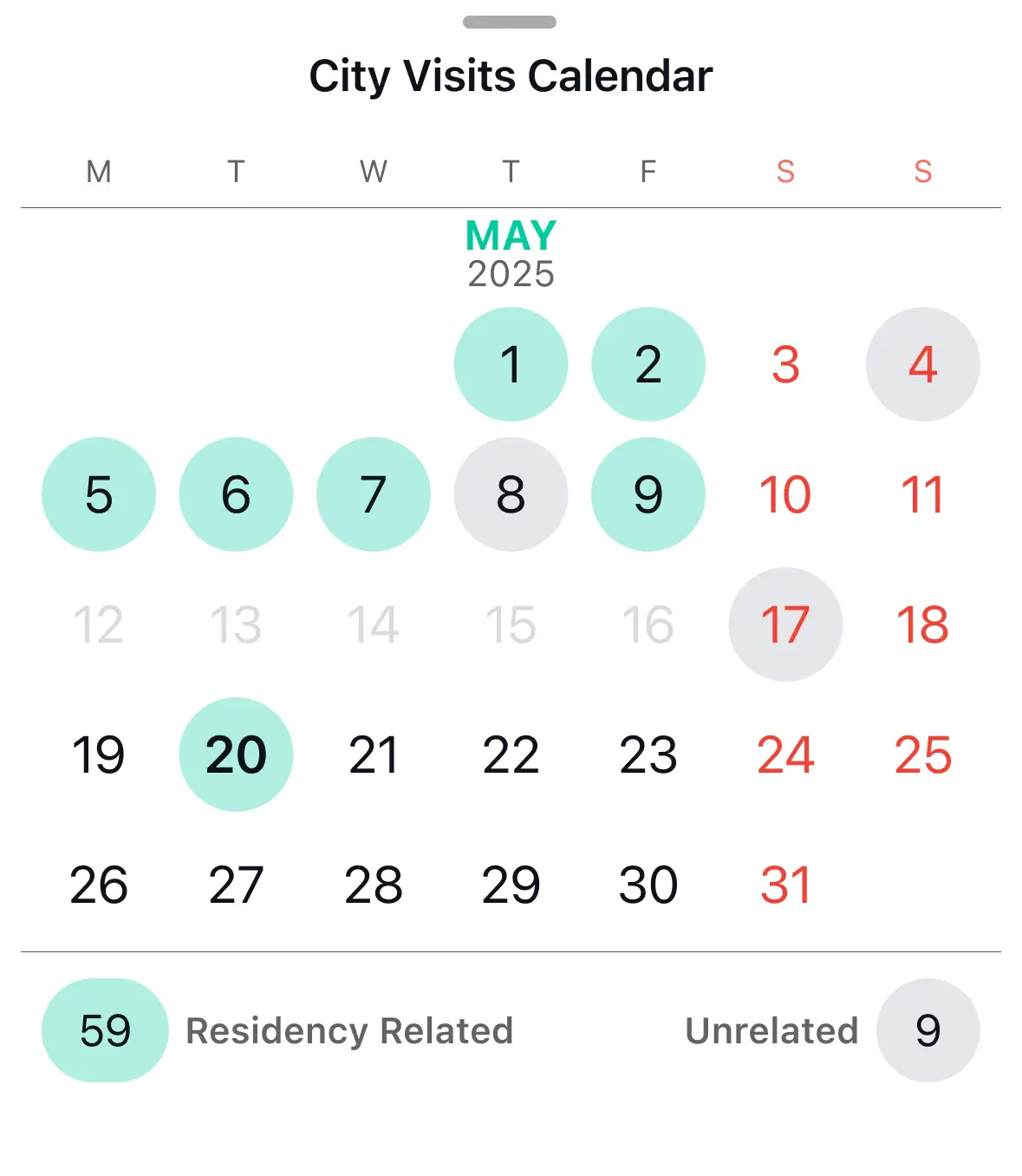

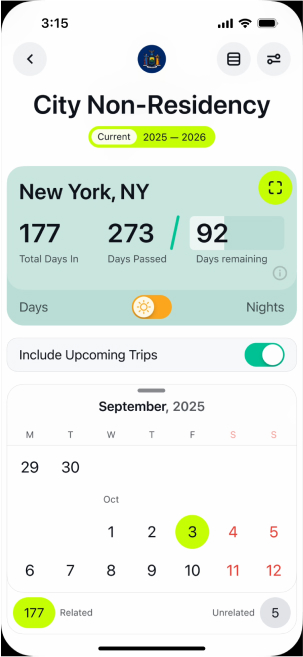

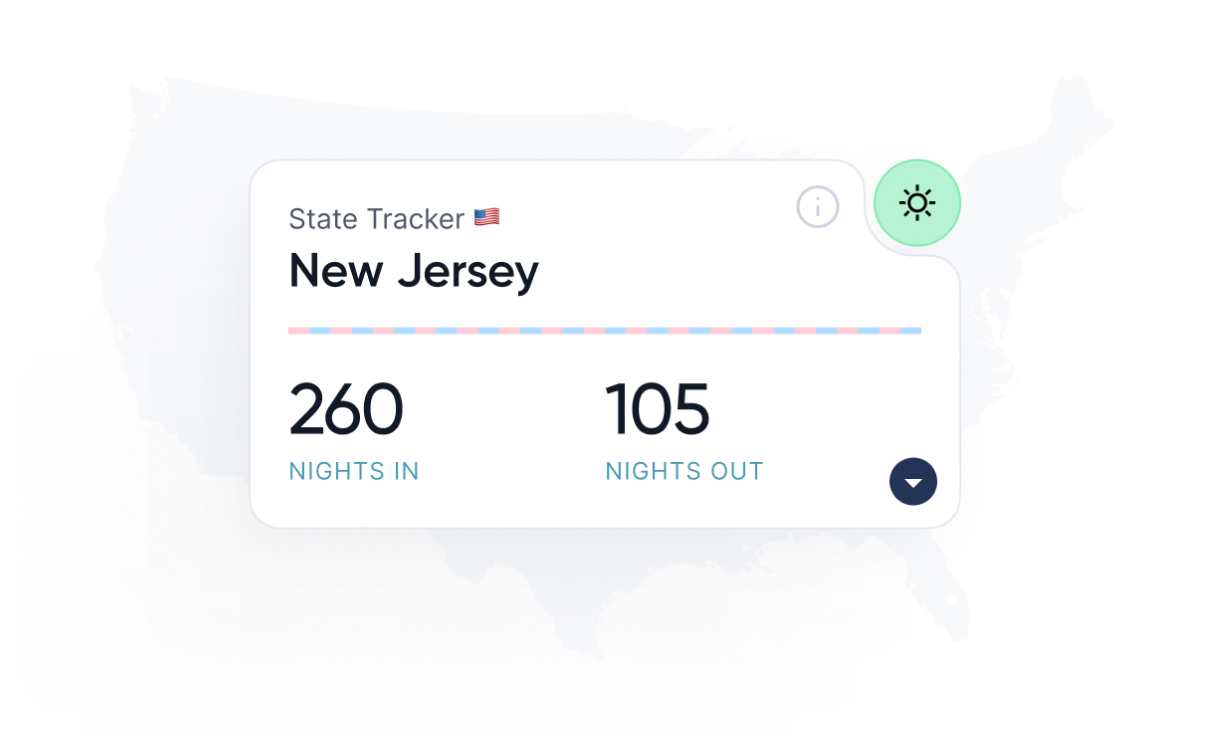

US City & State

Day Count

Flamingo Compliance auto-tracks your days in every US state and your workdays in key cities. You can select residency-eligible days, mark non-work days, and receive warnings as you approach residency status.

*Currently available only for New York City, NY. Other cities coming soon.

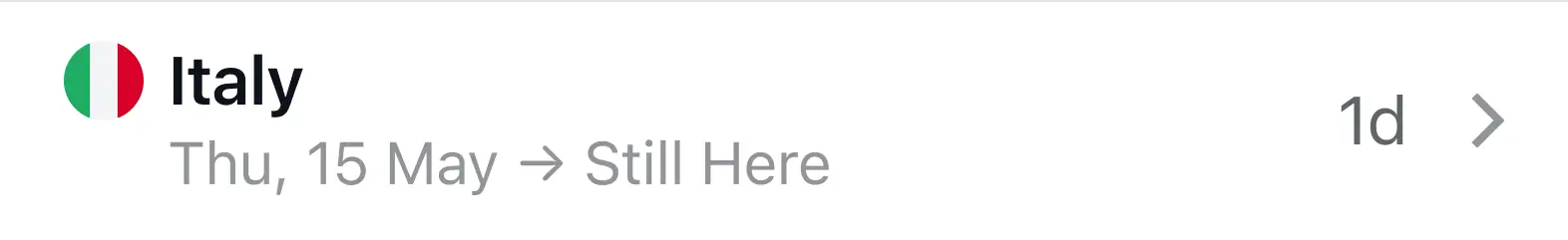

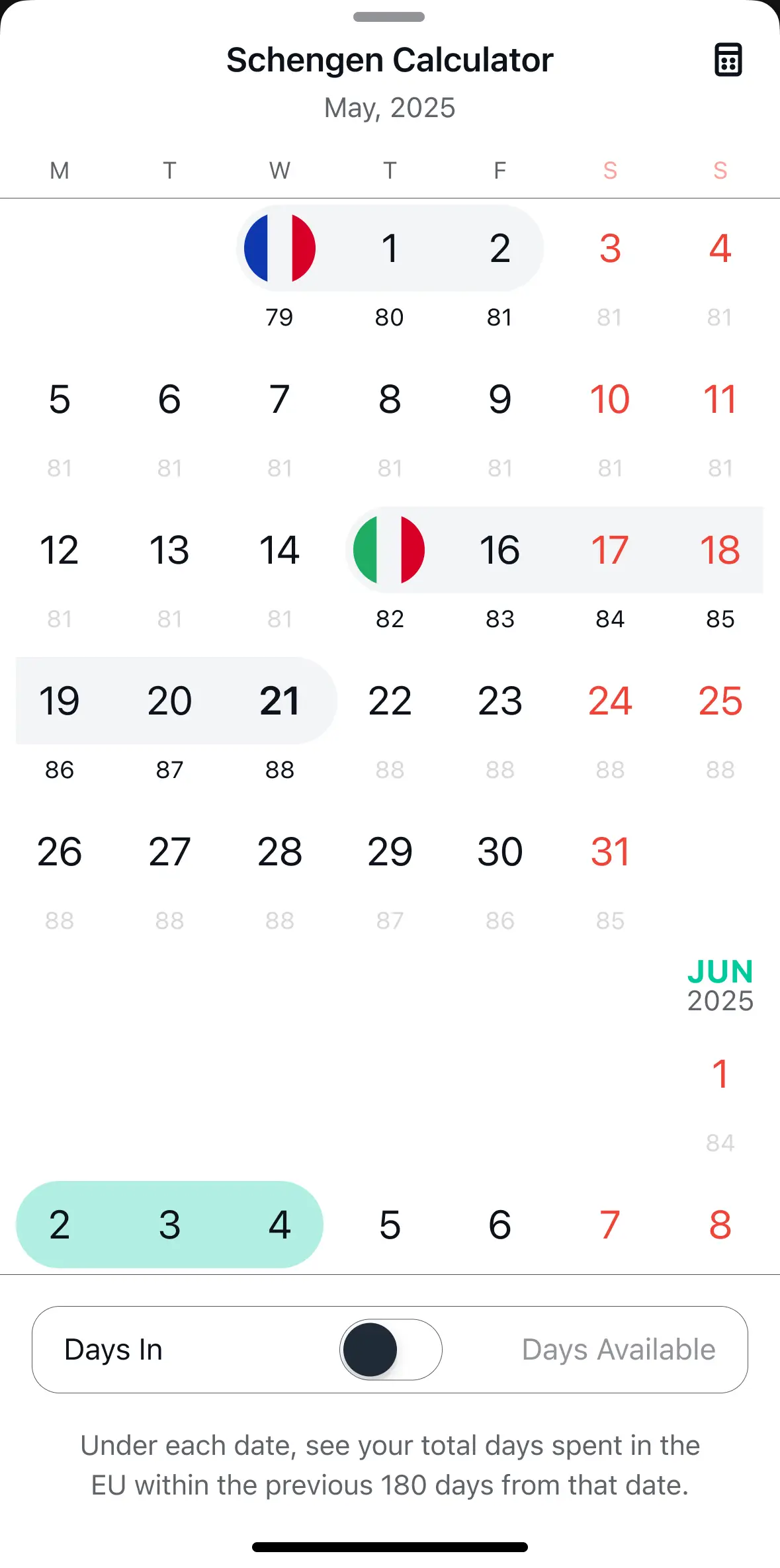

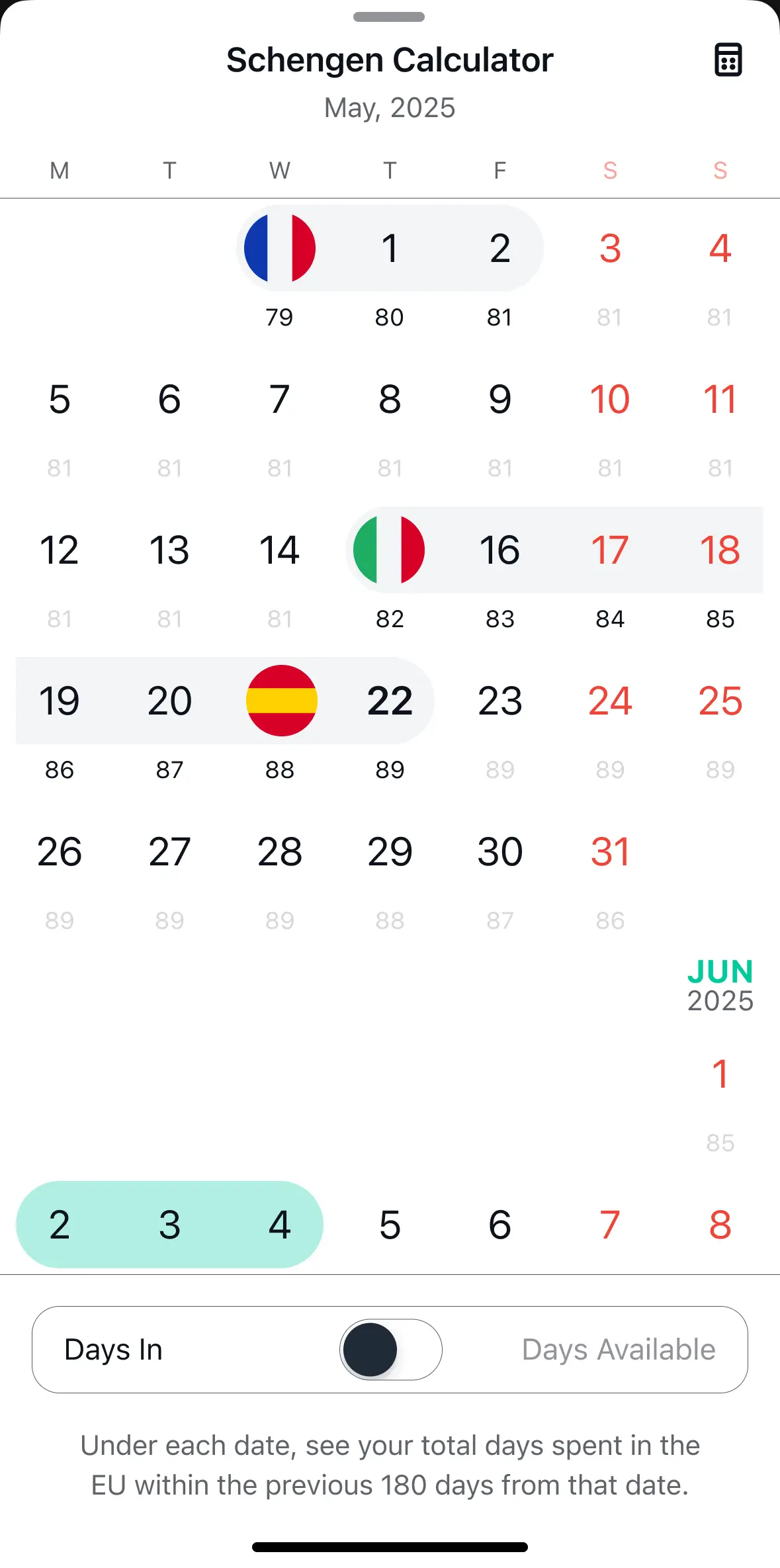

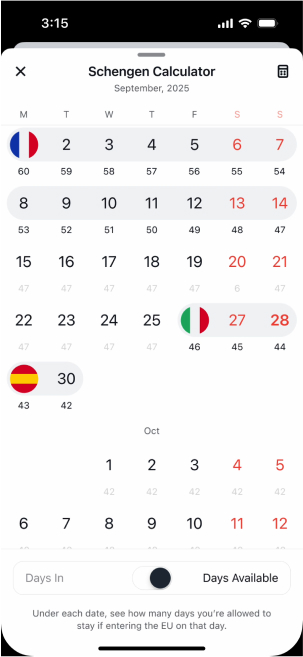

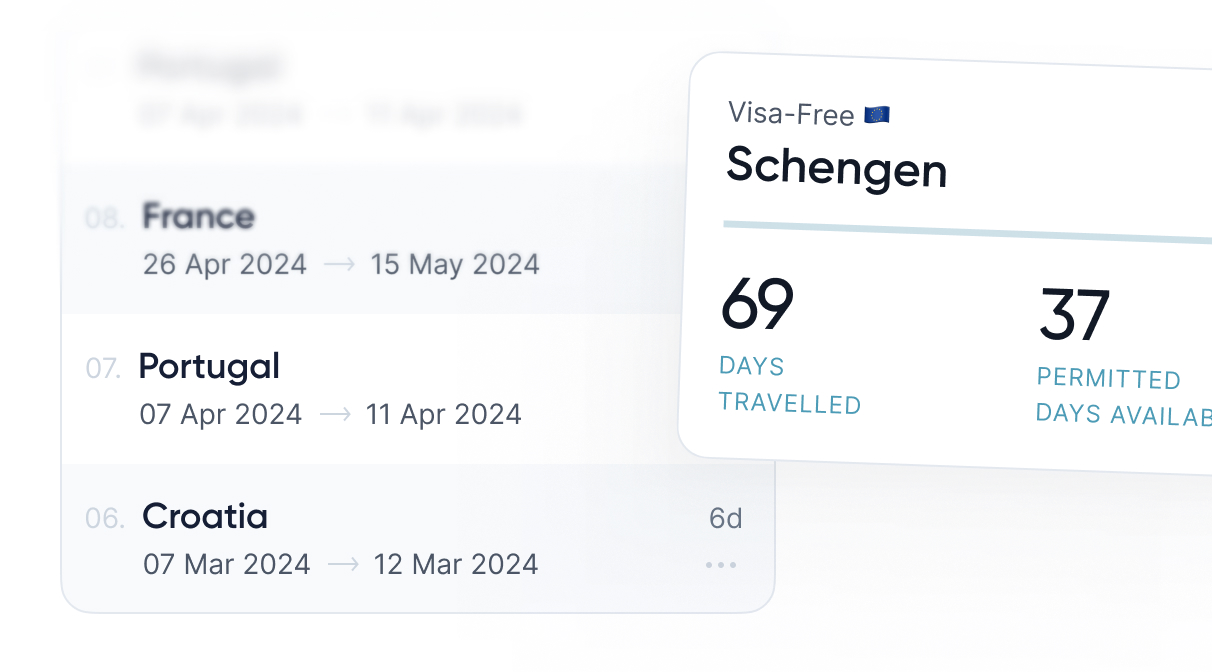

Schengen Area

Calculator

The built-in Schengen calculator uses your cumulative days spent in Schengen countries to display days you have left and allows you to plan future trips to the EU based on the 90/180 day rule.

Flight Crew Exemption Mode

Long-Term Visa & Residence Permit Tracking

Passport Index

Export

Reports

Security

Your Privacy is Our Priority

Important

Notifications

Flamingo Compliance alerts you when you are reaching your residency threshold, visa-free stay limits,or visa expiration dates, helping you avoid any issues with authorities.

Complete

Privacy

Your travel, residency and visa data is stored locally only on your device. We do not collect, nor store, your information on our servers.

*With a Flamingo Compliance subscription you can sync your data via iCloud across all your devices.

Bank-Level

Data Security

Flamingo Compliance employs multiple layers of data backups, guaranteeing peace of mind for your valuable travel information.

Frequently Asked Questions

Find quick answers to common questions about using the Flamingo Compliance app.

Why do I need to set Location Services to "Always"?

Why do I have to open the app every month?

Can you see my precise location at any given time?

Can I add my past travel history from before I installed the app?

Can I use Flamingo Compliance for free?

Can I track my travel to individual UK countries (England, Scotland, Wales, Northern Ireland) separately from the UK?

Do you have an Android version?

Flamingo Compliance helps you with:

USA Substantial Presence Test and Physical Presence Test

UK Statutory Residence Test (SRT)

EU Schengen Area tracking, 90 in 180 days rule

France Tax Residency Test

Switzerland 90-day rule

Canada residence / physical presence requirements

Puerto Rico Act 60 (act 20/22) day counting

India residence status day counting

Malaysia residence status day counting

South Africa’s physical presence rule

Cyprus residency day counting

Israel residency

Italy 183-day rule, Australia 183-day rule, Spain 183-day rule, Brazil 183-day rule

New Zealand 325-day rule

Cyprus 60-day rule

Download

Flamingo Compliance Now

A tax residency and visa compliance platform designed for tax residents, business executives, HNWIs, dual residents, expats, digital nomads, golden visa holders, remote workers, and other global citizens.